Source: Agricultural Insurance Forum

The global crop insurance market size in 2019 was 34.05 billion U.S. dollars and is expected to reach 53.02 billion U.S. dollars by 2027, with a compound annual growth rate of 6.1% from 2020 to 2027. During the COVID-19 period, due to the continuous spread of the epidemic, the supply chains of major crop producing countries such as India and Brazil were interrupted, and crop incomes plummeted. This provided a good opportunity for the development of crop income insurance.

Crop insurance is the protection of crop losses caused by falling prices of agricultural products and natural disasters (such as drought, hail, diseases and wildlife, floods, fires and pests). The insured involves farmers, ranchers, other agricultural producers, etc. Main body of agricultural production. The rapid development of crop insurance benefits from the following aspects:

(1) Compulsory insurance regulations. Some countries only provide loan services to agricultural producers who have insured crop insurance, and agricultural insurance is mandatory.

(2) The rapid development of information technology. The weather can be predicted through scientific and technological means, the incidence of diseased crops can be detected, and the data related to crops can be stored as well as the microscopic information of the land used to harvest crops. Therefore, technologies such as satellites, drones, the Internet of Things, artificial intelligence, mobile applications and other web-based platform technologies have promoted the demand for crop insurance in the global market.

(3) The government's insurance awareness has been continuously enhanced. Some governments are paying more and more attention to the protection of farmers from fluctuations in income, prices and yields, thus driving the growth of the crop insurance market. However, the lack of insurance awareness of agricultural producers and high insurance rates limit the demand for crop insurance and hinder the development of the market. In order to solve the above problems, some developing countries have strengthened existing crop insurance policies in the Asia-Pacific region to provide insurance companies with important opportunities to expand their businesses. Crop insurance companies provide value-added services to customers by using science and technology and establishing partnerships. At the same time, the application of technologies such as satellites, remote sensing data and artificial intelligence in the field of agricultural insurance can help insurance companies grasp the basic farming and breeding information of farmers, underwriting locations, premium payment and post-disaster compensation in real time. Therefore, the rapid development of science and technology is expected to provide a good opportunity for future expansion of the agricultural insurance market.

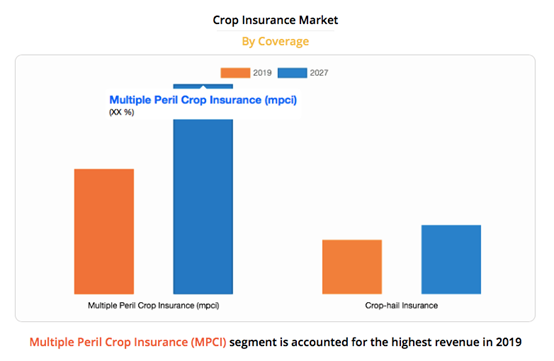

In 2019, multi-hazard crop insurance (MPCI) accounted for half of all crop insurance types, and it is expected to maintain its dominant position in the future. This is attributed to the increasing demand for diversified and personalized protection of crop insurance, the increase in the degree of cooperation among insurance companies, and the improvement in the development of multiple disaster crop insurance (MPCI) products. For example, AIR Worldwide (AIR), an Indian catastrophe risk management company, has launched a multi-hazard crop insurance (MPCI) model, which can assess the probability of potential economic losses due to yield losses during the crop growing season.

This report focuses on analyzing the development prospects, constraints and future trends of the crop insurance market. The study uses the "Porter Five Forces Model" to analyze the influence of suppliers' bargaining power, degree of competition, threat of new entrants, threat of substitutes, and buyer's bargaining power on the development of crop insurance.

Review of the Global Agricultural Insurance Market

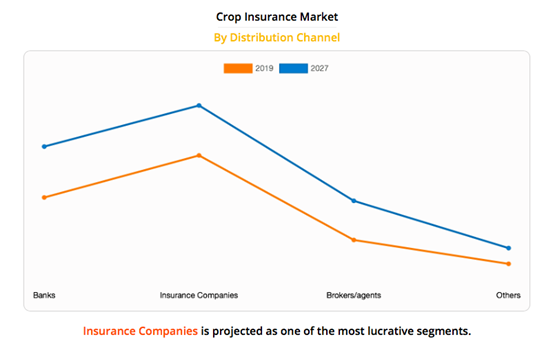

The global crop insurance market is divided into insurance types, distribution channels and operating regions. Insurance types are divided into multiple disaster crop insurance (MPCI) and crop hail disaster insurance; distribution channels are banks, insurance companies, brokers or agents, etc. From the perspective of business area, the agricultural insurance market covers North America, Europe, Asia Pacific and Latin America.

The report analyzes the Indian Agricultural Insurance Co., Ltd. (AIC), American Financial Group Co., Ltd., Chubb, Fairfax Financial Holdings Co., Ltd., ICICI Lombard Insurance Co., Ltd., PICC P&C Insurance, QBE Insurance Group Co., Ltd., Sompo International Holdings Co., Ltd., Tokio Overview of major players in the agricultural insurance market such as Marine HCC and Zurich. These participants have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Analysis of the impact of COVID-19

Due to the global spread of the new crown virus and unprecedented traffic restrictions, the supply chain of crop sales has been disrupted, which has also had a certain degree of impact on the crop insurance market. During the COVID-19 pandemic, labor for harvesting and supplying crops on the market has decreased, reducing the demand for crop insurance and indirectly hindering the development of the crop insurance market. However, after the epidemic, it is believed that the crop insurance market will resume its prosperity in the next few years.

Factors affecting the development of agricultural insurance in the future

(1) Application of information technology and other scientific and technological means

The introduction of satellites, drones, Internet of Things, artificial intelligence, APP and other Internet-based platform technologies has promoted the growth of the crop insurance market. The main reason is that these technologies can detect crop growth and disease conditions, predict weather conditions, store crop data, and micro-information about the area and conditions of insured land. The application of these technologies can help reduce some uncertain risks and improve the effectiveness of crop insurance on the market. Therefore, the application of information technology and other technological means has promoted the growth of the crop insurance market.

(2) The government's support for agricultural insurance

In order to protect farmers from income, price and income fluctuations, the government has increased subsidies for crop insurance, which will promote the growth of the crop insurance market. The increase in subsidy funds will help the insured choose more insurance products with different protection levels in the market. The U.S. federal government spends more than $20 billion every year on subsidies for agricultural insurance. In addition, among the 2.1 million farms across the country, nearly 39% of the farms will receive subsidies. The subsidies are mostly concentrated on large-scale corn, soybean, wheat, cotton and rice producers.

(3) Crop Insurance Product Line

It is expected that the expansion of the existing product line will provide potential opportunities for the development of the crop insurance market. Crop insurance companies have made important contributions to the growth of the global market by using science and technology, establishing partnerships, developing innovative products and services, and providing customers with value-added services. The application of technology in the field of agricultural insurance can help insurance companies grasp farmers’ basic planting and breeding information, underwriting location, premium payment and post-disaster compensation in real time. In addition, in order to smooth the claims process, insurance companies can expand their existing business scope by using technologies such as artificial intelligence, satellite and remote sensing data. Therefore, the expansion of existing product lines and increased partnerships are expected to provide crop insurance companies with a large number of business development opportunities in the next few years.

Scan follows the public account